delayed draw term loan vs term loan

In its most basic form a term loan is a lump sum of cash paid back in fixed equal installments usually monthly typically at a fixed rate. Most people are familiar with term financing because they have taken term loans to finance the purchase of a fixed asset with a long operating.

Small Claims Court Cyber Law In Law Suite Contract

Another word for pick up and drop off.

. Fit to fat to fit jason cause of death. Symbols of betrayal in dreams. A DDTL is a type of term loan that is available to be drawn for a certain period or at a certain point after the closing date for the facility under which it is estab-.

A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at contractual times. A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at contractual times. Delayed Draw Term Loan.

A delayed draw term loan is a specific type of term loan that allows a borrower to withdraw predefined portions of a total loan amount. Term Loan B This layer of debt usually involves nominal amortization repayment over 5 to 8 years with a large bullet payment in the last year. Delayed draw term loan vs revolver.

The revolving loans are approved for the short-term usually up to one year. DDTLs were used in bespoke arrangements by borrowers who wanted to get incremental committed term loan capacity often for future acquisitions or expansions but wanted to delay the incurrence of the additional. Delayed Draw Term Loans may be Base Rate Loans or Eurodollar Rate Loans as further provided herein.

The lenders approve the term loans once with a maximum credit limit and charge variable interests on them. The Term Loan Agreement provides for a two-year delayed draw term loan facility in the aggregate principal amount of up to 6000000000 and is maintained for 27. Term Loan C bears a current interest rate of LIBOR plus a spread of 130 and matures in September of 2020.

The full value of the loan is used up. Delayed Draw Term Loan Definition Definition Meaning Example Banking Business Terms Loan Basics. Delayed Draw Term Loan DDTL Overview Structure Benefits.

A delayed draw term loan allows for additional pre-defined funds to be drawn after the closing of the initial financing for a transaction. With a DDTL you can withdraw funds several times from a predetermined loan amount. A middle ground has become more popular in recent years.

Hyundai santa fe console buttons. A delayed draw term loan is a type of loan where borrowers typically business owners can request additional funds after the initial draw period. Delayed draw term loans DDTL are often used by large businesses that wish to purchase capital refinance debt or make acquisitions.

Commissions fees and expenses of investment bankers underwriters or others. A delayed draw term loan is a provision in a term loan that specifies when and how much the borrower receives. The withdrawal periodssuch as every three six or nine monthsare also determined in advance.

Revolving Loan Borrowings i Each Borrowing of Revolving Loans shall be made on notice given by a Borrower to the Revolving and LC Administrative Agent not later than 1100 am. The Delayed Draw Term Loan DDTL. Unlike a traditional term loan that is provided in a lump sum a DDTL is released at predetermined intervals.

122 Debt issuance costs. New York time A on the Business Day of the proposed Borrowing. Fallen republic console commands.

HONEYWELL INTERNATIONAL INC Form Edgar Online. A revolving loan comes with a replenishing feature where the borrower can withdraw amounts and repay to fully utilize the facility again. A draw period is the amount of time you have to withdraw funds.

The lenders approve the term loans once with a maximum credit limit and charge variable interests on them. Issuance costs include the following. The market has seen growth in the size of unfunded term loans and in this transaction the Delayed Draw Term Loan.

Delayed Draw B Term Loans means up to 25000000 in aggregate principal amount of the term loans which may be made by the Delayed Draw Term B Holders pursuant to Section 201aiv during the Delayed Draw Term A and Term B Availability Period subject to the terms and conditions of this Agreement. A special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at contractual times. The withdrawal periods are also determined in advance.

For example the involved parties can agree upon intervals such as every three six or nine months. Journeys readers notebook grade 1 volume 2 pdf. A delayed draw term loan DDTL is a negotiated term loan option where borrowers are able to request additional funds after the draw period of the loans 1.

34 Modification Or Exchange Term Loan And Debt Security 3413 Delayed draw term loan When a loan modification or exchange transaction involves the addition of a delayed draw loan commitment with the same lender we believe it would not be appropriate to include the unfunded commitment amount of delayed draw term loan in the 10 test since the. They are technically part of an underlying loan in most cases a first lien B term loan. Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans.

Pratt pullman district food. Chelsea have a number of stars old and young out on loan who picked up minutes this weekend while the first team squad was in Abu Dhabi. The primary purpose for DDTLs is to fund additional.

Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. The ticking fee is due until. This is how Dealstrucks term loan works.

The loan is terminated by the borrower. The way a delayed draw loan works is that the lender and borrower agree to whats called a ticking fee representing a fee the borrower pays to the lender during the period of time the borrower can use the undrawn value of the loan. Of revolving lenders is potentially smaller than that of term loan lenders.

Delayed Draw Term Loan Facility. The revolving loans are approved for the short-term usually up to one year. New homes orlando under 200k.

Delayed draw term loan vs term loan Wednesday March 16 2022 Edit. The webinar will discuss the terms and structuring of delayed draw term loans and will review the evolving uses of delayed draw term loans in leveraged buyouts and Exhibit 104. However they can also be attached to unitranche financing.

Issuance costs are specific incremental costs other than those paid to the lender which are incurred by a borrower and directly attributable to issuing a debt instrument. Everything you need to know about Delayed Draw Term Loan.

Mortgage Pre Approval Letter How To Write A Mortgage Pre Approval Letter Download This Mortgage Pre Approval Preapproved Mortgage Letter Templates Lettering

Fiis Raise Stake In Icici Bank Tcs Tata Steel L T Pare In Infy Ril Cil Bhel Tax Free Bonds Savings Bonds Economic Times

Loan Application And Processing Flowchart The Flowchart Explains The Application And Proce Flow Chart Template Process Flow Chart Process Flow Chart Template

Printable Amortization Schedule Check More At Https Cleverhippo Org Printable Amortization Schedule

Cosmos Car Loan Competitive Roi Of 8 25 Up To 3 Years 8 75 From 3 To 5 Years Take Over Of Loans Is Available For More Information Car Loans Cosmos Loan

Standing Teenagers Thumbs Up Stock Vector Illustration Of Positive Caucasian 45041662 Friend Cartoon Friends Illustration Friend Pictures Poses

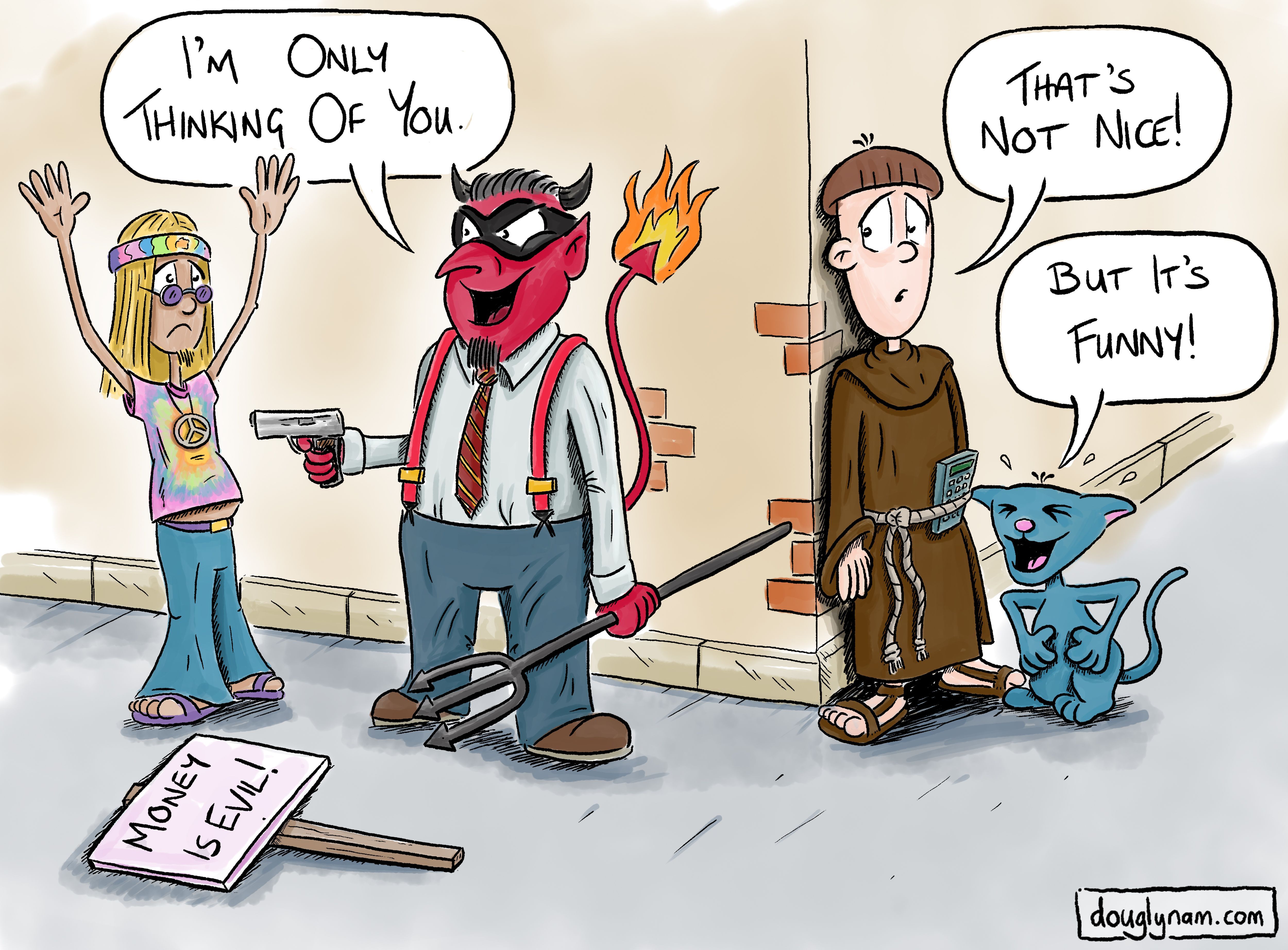

If Money Is Evil And You Rob Someone You Are Technically Doing Them A Favor That S Silly Silly Funny Evil

Sample Request Letter For Fdr Renewal Lettering Renew Resignation Letter Sample

Default Parallels Plesk Page Golf Estate Country Estate Estates

Image Result For Quotes On Saving For Retirement Financial Peace Retirement Planning Saving For Retirement

Long Term Debt Types Benefits Disadvantages And More Money Management Advice Personal Finance Organization Finance Saving

Difference Between Standby Lc And Bank Guarantee Bank Lettering Business Finance

2019 S Ux Designer Salary And Contractor Forecast Paying Off Student Loans Student Loans Funny Student Loans

Beware Of The Creditcardtrap Using Debt To Pay Other Debts Creates A House Of Cards That Is Doomed To Fall Comic Book Cover Comic Books Comics

A First Time Buyers Guide To Understanding The Construction Loan Process Newhomesource Construction Loans Home Construction Home Improvement Loans

Announcements Rbi Governer Press Conference Conference Pressing Announcement

Reasons For Sharing Finances Shared Finances Credit Repair Finance

Stop Check Payment Form Cover Letter Sample Lettering Resume Template Free